Our Business Debt Collection PDFs

Table of ContentsNot known Factual Statements About Dental Debt Collection 6 Simple Techniques For Private Schools Debt CollectionIndicators on Business Debt Collection You Need To KnowBusiness Debt Collection - TruthsSee This Report on Personal Debt Collection

Learn more concerning exactly how to find financial debt collection scams. You can ask a collector to quit contacting you as well as dispute the financial obligation if you think it's incorrect. If you carry out in reality owe the financial obligation, there are three basic ways to pay it off: accept a repayment plan, clean it out with a solitary settlement or negotiate a settlement.The collection agency can not inform these individuals that you owe cash. The collection company can call another person just as soon as.

It can, but does not have to approve a partial payment plan (Business Debt Collection). A collector can ask that you write a post-dated check, yet you can not be needed to do so. If you offer a debt collector a post-dated check, under federal legislation the check can not be transferred before the date composed on it

The ideal financial debt collector work descriptions are succinct yet engaging. Offer information regarding your firm's worths, objective, and society, and also let prospects recognize exactly how they will add to the business's growth. Consider using bulleted lists to improve readability, consisting of no greater than six bullets per section. As soon as you have a solid very first draft, examine it with the hiring supervisor to guarantee all the information is precise and also the demands are purely necessary.

An Unbiased View of Dental Debt Collection

As an example, the Fair Debt Collection Practices Act (FDCPA) is a government regulation implemented by the Federal Profession Payment that shields the civil liberties of customers by forbiding specific techniques of financial debt collection. The FDCPA relates to the practices of financial debt enthusiasts and also lawyers. It does not relate to creditors who are trying to recover their very own debts.

The FDCPA does not apply to all debts. It does not apply to the collection of service or company financial debts.

It is not meant to be legal recommendations concerning your certain trouble or to substitute for the advice of a lawyer.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/PD7DY6QJL5C3ZM2U5JKN47NZKA.jpg)

The smart Trick of Dental Debt Collection That Nobody is Talking About

Personal, family members and also home financial debts are covered under the Federal Fair Financial Debt Collection description Act. This includes cash owed for treatment, credit account or cars and truck purchases. Business Debt Collection. A debt collection agency is any individual aside from the lender that consistently collects or attempts to collect financial debts that are owed to others which arised from customer deals

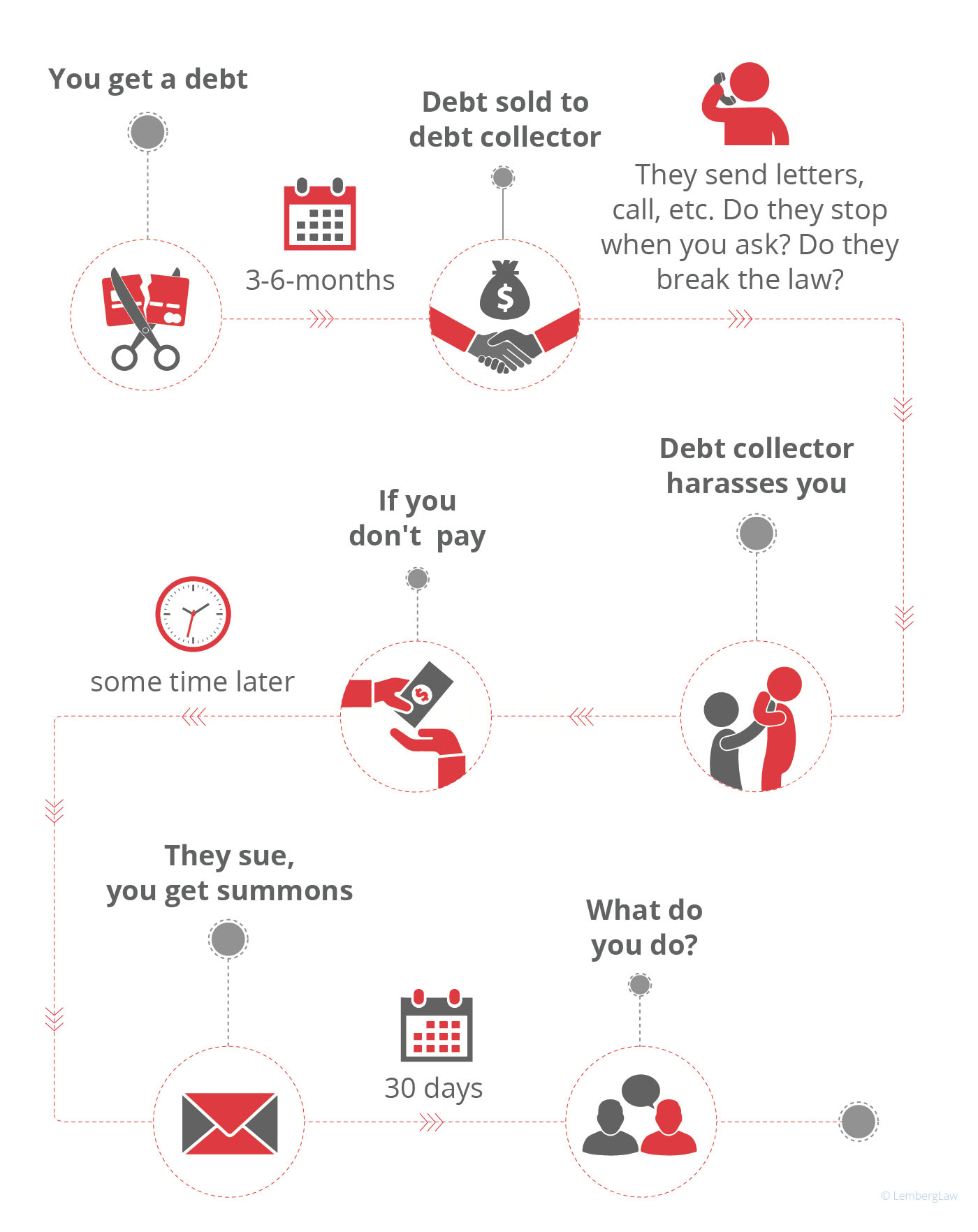

As soon as a financial debt collection agency has informed you by phone, she or he must, within five days, send you a written notice disclosing the over here quantity you owe, the name of the lender to whom you owe cash, and what to do if you contest the debt. A debt collector may NOT: harass, suppress or abuse anybody (i.

You can stop a financial obligation collection agency from contacting you by creating a letter to the collection agency telling him or her to quit. As soon as the agency receives your letter, it might not call you once more other than to inform you that some certain action will be taken. A debt collector might not call you if, within 30 days after the collector's initial call, you send out the enthusiast a letter specifying that you do not owe the money.

Debt Collection Agency Fundamentals Explained

This material is readily available in alternate layout upon demand.

Instead, the lender could either employ a company that is hired to accumulate third-party financial obligations or offer the financial debt to a debt collection agency. As soon as the financial obligation has been marketed to a debt collection agency, you might begin to get calls and/or letters from that agency. The financial debt collection sector is greatly regulated, and also consumers have lots of civil liberties when it concerns taking care of expense collection agencies.

Despite this, financial obligation collectors will attempt whatever in their power to obtain you to pay your old financial debt. A financial obligation collection agency can be either a specific person or an agency.

Financial obligation debt collection agency are hired by financial institutions and also are typically paid a portion of the amount of the financial debt they recoup for the creditor. The percentage a collection company charges is commonly based on the age of the debt as well as the quantity of the debt. Older financial obligations or greater financial debts may take more time to gather, so a debt collection agency might bill a higher percent for collecting those.

Fascination About International Debt Collection

Others work with a contingency basis and just charge the financial institution if they are effective in collecting on the debt. The financial obligation collection company enters right into an arrangement with the lender to accumulate a portion of the debt the portion is stipulated by the financial institution. One creditor may not be prepared to work out for much less than the full quantity owed, while another may accept a negotiation for 50% of the debt.